Gambling Debts Uk

- The UK's revisions to its AML and counter-terrorist financing regime came into force on 10 January 2020. The significance of the new provisions for gambling operators includes, but is not limited to, the regulation of virtual currencies and increased levels of scrutiny required for transactions from high-risk countries.

- Online gambling is forecast to grow by 22% this year, and with it the number of punters with serious debts. The industry pays £3m into a trust to deal with the issue of problem gambling. A drop in the ocean, says Ian Semel from Gordon House, considering how much profit they make.

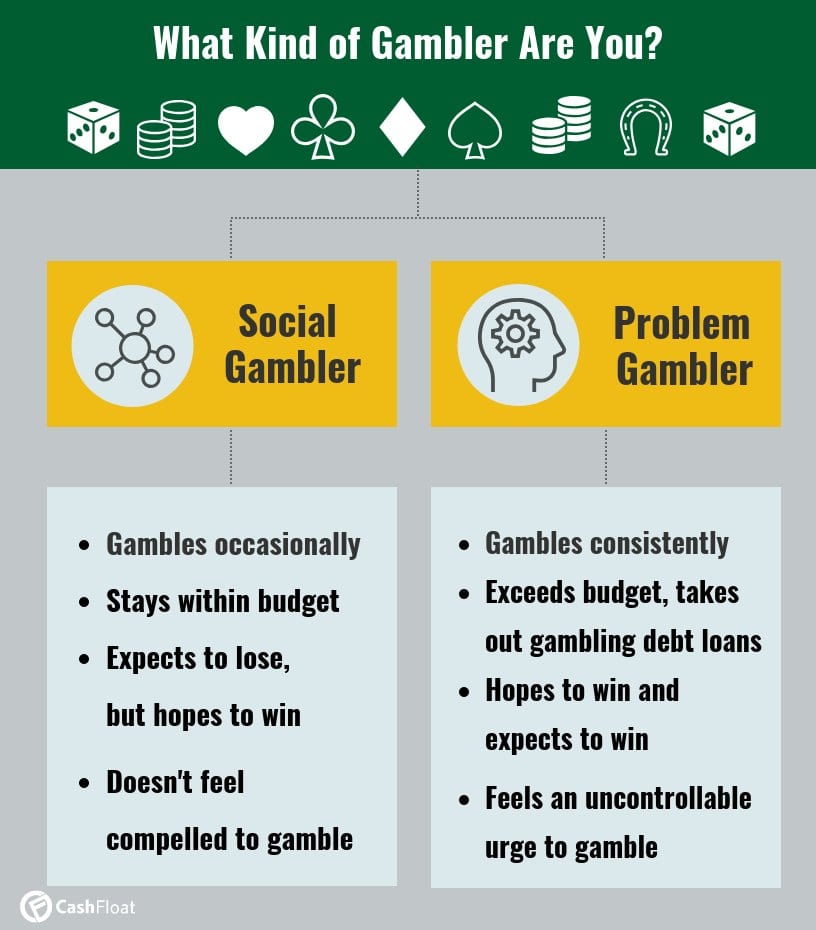

One of the most common results of a gambling problem is debt, and yet debt is also used by many gamblers as a reason for their continued gambling.

Can I be taken to court over gambling debts?

Debt: David hid his gambling from his wife and family (Image: PA Real Life). He even managed to remortgage the family home without his wife’s permission. “The house cost £30,000 and the.

No. Not if whomever you are placing the bet with is giving you credit to stake your bet.

But this rarely happens. Usually funds are loaded onto an account, a debit card or a cash only payment over a counter is made for a bet to be placed. This is why when betting online you must use a debit or prepaid card; a credit card is never accepted.

Yes, if money you’ve taken out on credit elsewhere you’ve decided to gamble with, or when gambling is the root of your financial problems; then the resulting debts are just like any other.

Gambling & IVAs

GamCare is the leading national provider of information, advice, support and free counselling for the prevention and treatment of problem gambling.

When making a proposal to your creditors to enter in to an IVA they are looking for a commitment that is realistic and achievable over the course of 60 months.

Clearly, any evidence of a recent gambling habit is not what they want to see. Therefore this will harm your chances of finding an IVA provider to make a proposal on your behalf.

An IVA is a legally binding formal solution so creditors need to see proof of circumstances; for example recent bank statements. Payments made to gambling companies or large withdrawals of cash without a reasonable explanation will cause concerns.

You’d need to evidence that gambling issues are behind you and you have committed to stopping. You have to prove that gambling accounts have been closed down and show a month or so of bank statements without any entries relating to gambling.

What is an IVA?

Gambling Debts Uk Online

An IVA or Individual Voluntary Arrangement is a popular solution for people with multiple unaffordable debts. You make agreed affordable payments for 60 months after which the remainder of includable debts are written off.

Gambling Debts Uk Debt

Gambling & Bankruptcy

When you become bankrupt, your financial affairs are inspected by a Court appointed official called the Official Receiver.

If it is considered that your behaviour has been reckless and this has contributed to, or to the extent, of your bankruptcy then the Official Receiver may seek to get a bankruptcy restriction order placed on you. This can extend the normal bankruptcy restrictions by up to 15 years.

Gambling Debts And Divorce Uk

Gambling may be taken into consideration when the official receiver considers whether a bankrupt is to blame for their financial position

We can help you today

Whatever your debt problems; whether gambling is a factor or not; we will look to offer you a formal solution that gets you out of debt as soon as possible.